Marketing

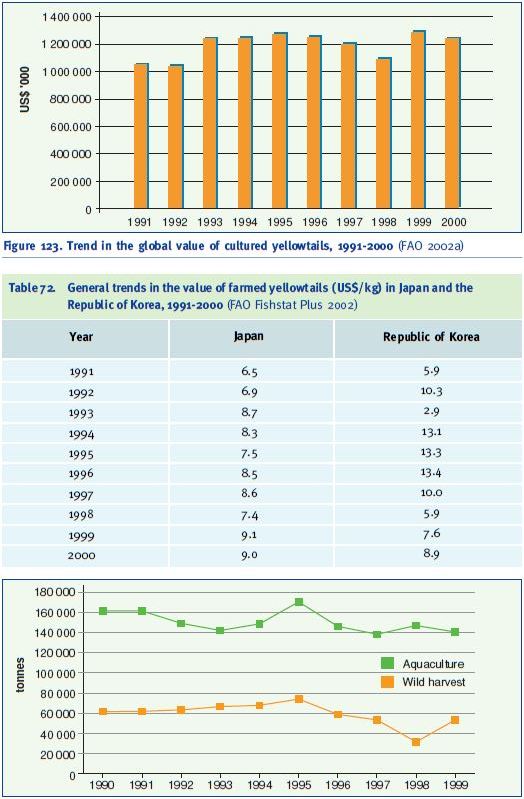

All three species of Seriola, greater amberjack, Japanese amberjack and yellowtail amberjack, have good market demand, mainly in Japan. Figure 123 shows the trend in the value of farmed yellowtail globally. About 99% of the aquaculture production of yellowtail is within Japan. There is no clear trend in the value of this production, which was about US$ 1.2 billion at the end

of the decade.

General trends in the unit value of farmed yellowtail in Japan and the Republic of Korea are given in Table 72. The main cultured species is Japanese amberjack (S. quinqueradiata); according to Nakada (2000), farmed production is typically in excess of 140 000 tonnes/year (Figure 124).

Figure 123. Trend in the global value of cultured yellowtails, 1991-2000 (FAO 2002a)

Table 72. General trends in the value of farmed yellowtails (US$/kg) in Japan and the Republic of Korea, 1991-2000 (FAO Fishstat Plus 2002)

Figure 124.Aquaculture production versus the wild catch for the Japanese amberjack (Seriola quinqueradiata) (Nakada 2000, modified)

Since the 1980s, Japanese yellowtail farmers have had a difficult time with increasing production costs due to the rising costs of feed (caused by a drastic decline in the volume of sardines caught in Japanese waters), a poor supply of juvenile Japanese amberjack (“mojako”), and the stagnant Japanese economy. At the same time, the more valuable species, greater amberjack (Seriola dumerili) and yellowtail amberjack (Seriola lalandi), have become more attractive to fish farmers, and since 1995 the number of “mojako” stocked has declined. The traditional culture of Japanese amberjack, which used to be highly profitable, is facing difficulties today; farmers are trying to introduce new species such as those previously cited to make the capture-based culture of yellowtail more profitable (Doi 1991; Nakada 2000).

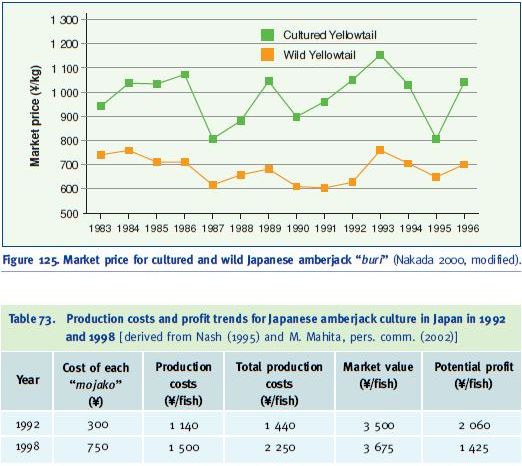

In Japan, the strongest competitor to cultured Japanese amberjack are small wild “buri”, typically 50 to 60 cm in body length, which are caught in set nets. If a large quantity of young “buri” are landed at one time, the market price drops as low as ? 200-300/kg, while ? 800/kg or more is the lowest price for cultured fish (Figure 125). In Japan, prices for 20 g “mojako” in 1992 were

? 100-120 (average ? 5 500/kg) and ? 200-250 for 30-40 g juveniles (average ? 6 429/kg), depending on the time of the year and availability. After rearing, these fish were sold 2 years later for ? 800-1 200/kg (Nash 1995). By 1998 the “mojako” price had risen to ? 15 000/kg, the average production cost for a yellowtail adult was ? 750/kg, and market prices for an adult yellowtail reached ? 1 050/kg (M. Mahita, pers. comm. 2002). Generally, a 20 g “mojako” reaches 3.5 kg (the average market size) in around 2 years. A comparison of production trends and profits is provided in Table 73.

Figure 125. Market price for cultured and wild Japanese amberjack “buri” (Nakada 2000, modified).

Table 73. Production costs and profit trends for Japanese amberjack culture in Japan in 1992 and 1998 [derived from Nash (1995) and M. Mahita, pers. comm. (2002)]

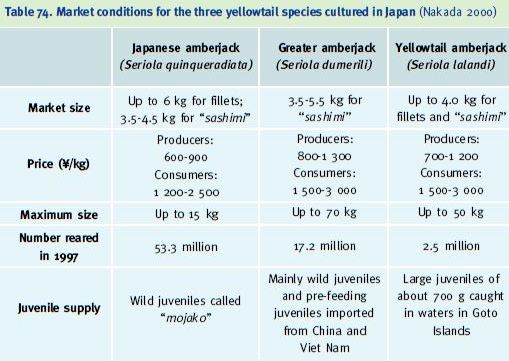

Greater amberjack aquaculture has been growing rapidly and this species now rivals Japanese amberjack. In 1998, the price of greater amberjack juveniles was ? 500/kg for 50 g fish and ? 1 500/kg for 600 g fish. Japan, via Hong Kong, has been importing wild juveniles caught in China and Viet Nam since 1986 (Nakada 2000). Now, because of its high quality, greater amberjack usually command much higher prices in Japan than cultured Japanese amberjack in wholesale markets (? 800-1 300/kg versus ? 600-900/kg, as shown in Table 74). Yellowtail amberjack meet with the highest favour as a “sashimi” (Nakada 2000). This species is also becoming a valuable new species for aquaculture in South Australia, but other countries are watching closely and several are currently testing this species.

Table 74. Market conditions for the three yellowtail species cultured in Japan (Nakada 2000)

Large juveniles of about 700 g caught in waters in Goto Islands

As consumers have become more selective about product quality, farmers have started to concentrate on trying to produce higher quality fish. The branding of special yellowtail products has been shown to be effective in sourcing better markets. Stable product quality, obtained by discarding second grade fish and paying special attention to freshness, has become highly valued by the intermediate dealers. Sales have increased in supermarkets and retail fish stores, through the marketing of special brands produced by such organizations as the Kagawa and Kagoshima Federation of Fisheries Co-operatives. Kagoshima Prefecture is the top producer of both farmed Japanese amberjack and greater amberjack. Some of the fish processing facilities in this Prefecture obtained an approval by authoritative private verification organizations in 1998. Complying with the HACCP regulations, these facilities have been ensuring food safety and keeping a high level of hygiene control. The large-scale farming of the greater amberjack in Kagoshima Prefecture began in 1990, and Kagoshima is now the country’s main producer. Greater amberjack marketed with the Kagoshima label have a high reputation with consumers. The fish are being consumed more and more as “sashimi”, and is considered a delicacy in the Tokyo area.

The market for cultured fish in Japan can be divided principally into high class Japanese restaurants (that deal mainly with live fish), wholesale stores and supermarkets (dealing with fresh and frozen fishes), and direct delivery of processed fillets to individual restaurants and homes. Fish farmers are having difficulty making a profit now, owing to the stagnant economy and excessive competition among themselves. Recently, direct deliveries from the producer to the consumer have begun. The Internet, mail or fax can be used for ordering and reliable payment collection. Producers keep lists of reliable customers and can estimate future demands. Consumers have recognized the difference in the quality of the product, so this type of delivery system shows a promising future and could help stabilize fish farming.

In Spain, greater amberjack were cultured until 1999, when production stopped. At the current time there are no farms officially producing Seriola in that country. Some farms devoted to seabass/seabream or tuna are producing limited amounts to test the feasibility and market for commercial production. The main limiting factor is the source of juveniles for on-growing purposes. These always come from local wild populations, and are scarce or extremely expensive: € 2-3 each for 50 g Seriola (A. Garcia Gomez, pers. comm. 2002).

South Australia is beginning to harvest yellowtail amberjack (S. lalandi) to satisfy increasing export demand. The two main markets for Australian “hiramasa” are for high quality “sashimi” in Japan and the USA, and as a table fish in Europe and Asia. “Hiramasa” is the second most popular “sashimi” product in Japan after tuna. It is also highly popular as a table fish in Europe. The marketing strategy is to promote a combination of both “sashimi” and table fish to achieve a good marketing balance. The fast growing kingfish (yellowtail amberjack) reach about 2-3 kg within 12-14 months, a suitable size for table fish. Alternatively, they can be grown out to

4-5 kg in 18 months for “sashimi”. Studies are needed to ascertain the best profit ratios from “sashimi” and table fish. The South Australian Aquaculture Management Company filled its first export order in 2001, harvesting 18 tonnes of yellowtail amberjack destined for the United States, with 23 companies from all over the world (including Asia, Europe and United States) showing interest. This type of fish farming could turn into a major new industry for South Australia (Anonymous 2001).

Yellowtail are mainly marketed fresh, chilled or frozen at a price ranging from US$ 5-18/kg, depending on the region and the season of the year. In Italy, the average market price for greater amberjack is € 20/kg. One of the most important factors is that this fish can be sold at every size (whole, fillets or steaks and portions).

Fish quality deteriorates much faster than that of land animals. Therefore, it is vital when dealing with fish to get the product to consumers as fast as possible after harvest. Fish meat can be served as “sashimi” for about three days in cold storage, depending on rearing conditions and treatment after harvest. Rapid killing, bleeding, filleting, and proper packaging and refrigeration results in excellent quality yellowtail. Greater amberjack and yellowtail amberjack are more popular than Japanese amberjack because they can be kept for more than three days under refrigeration without losing their flavour, colour, and firmness. Currently, demand for them exceeds the supply (Nakada 2000).

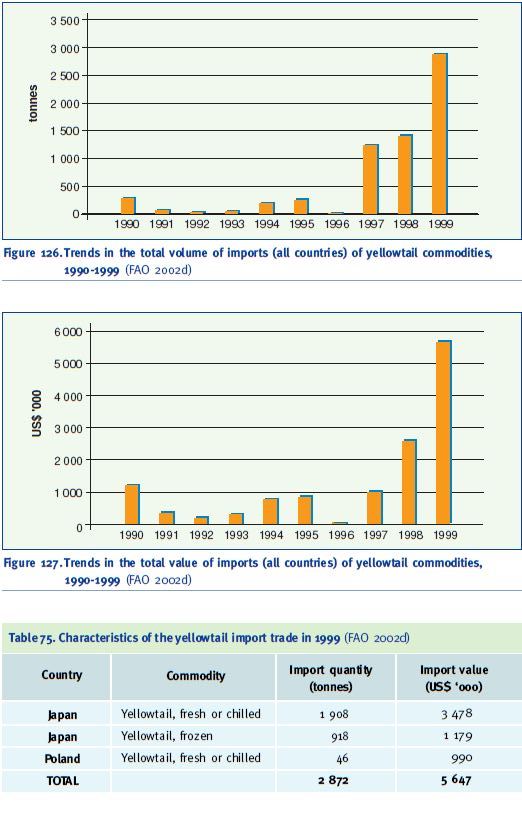

Yellowtail commodities have also an import-export trade. Imports are small but show an increasing trend in recent years; their volume and value are shown in Figures 126 and 127, respectively. In 1999 Japan was the leading importing country (Table 75).

Figure 126.Trends in the total volume of imports (all countries) of yellowtail commodities, 1990-1999 (FAO 2002d)

Figure 127.Trends in the total value of imports (all countries) of yellowtail commodities, 1990-1999 (FAO 2002d)

Table 75. Characteristics of the yellowtail import trade in 1999 (FAO 2002d)

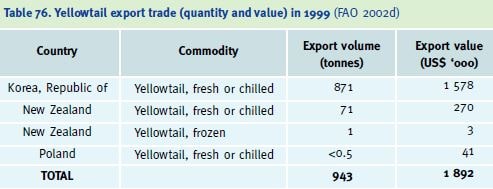

There is a generally increasing trend in the total export of yellowtail (Table 76), which are mainly by the Republic of Korea. There is a very little interest in the production or trade of frozen yellowtail products. Most of yellowtail are traded fresh or chilled.

Table 76. Yellowtail export trade (quantity and value) in 1999 (FAO 2002d)

Japanese amberjack culture is well established in Japan and other Asian countries, and products have a good market image. However further expansion will be limited due to the supply of juveniles. Although juveniles are available from hatchery supplies, their quality is below that of wild-caught juveniles. The development of the two similar species, especially yellowtail amberjack, could see an increase in production in Japan, with other countries, notably Australia, entering the market. With the development of capture-based culture systems in the Mediterranean for tuna, there is renewed interest in greater amberjack culture in this region.

The key restrictions to increasing production are juvenile supply, the development of successful feeds and the introduction of better management practices to limit losses from “red tide” events, which themselves are probably due to poor feeding regimes. All yellowtail (Seriola spp.) products have the potential to be developed into many popular forms, and also into pre-prepared meals, which are becoming a major market in developed countries.