Marketing - grouper

Currently, grouper culture is almost entirely dependent upon the trade in high quality reef fish (Figure 66), owing to the relatively high production costs (due to poor survival rates in hatcheries; shortage of wild seed in many areas; poor survival in grow-out; and high feed costs, etc.).

The market is dominated by the trade through Hong Kong, which supplies the local market and is also destined for re-export to mainland China. Grouper market requirements are determined primarily by the tastes and customs of people of Cantonese origin.

The following factors are of particular significance:

? red colour is associated with luck and happiness. Thus groupers with red pigmentation command a premium price;

? the fish are commonly steamed whole. Firm flesh with low fat content and fine grained skin are therefore preferred;

? demand is closely related to cultural and economic cycles. Demand is greatest around Chinese New Year (January/February), and during the Wedding Season. During the rest of the year, demand may be related to economic prosperity and the business cycle;

? demand is dynamic. Different species become fashionable at different times;

? vivier boats (with tanks for live fish transportation) are large and discrete marketing units.

Figure 66: Groupers being sold in a fresh fish market in the Philippines

(Photo: Nelson A. Lopez)

A threshold level of production is required to access the services of a vivier boat; isolated producers may be highly dependent upon them to sell their production. The power of the vivier to control farm-gate prices is therefore considerable. Prices vary enormously. Aquaculturists should be cautious when basing their economic estimates on some of the higher published values. There are large premiums on some of the less common and larger species, and for the more desirable species there is a significant premium on size, with larger fish often commanding double the unit price of smaller, same species fish. This is related to the demand for fish of at least 1-2 kg in the high class restaurant market sector. The premium on size is much less for those species in lower demand in this sector. Industry mark-ups are high, reflecting the high transportation and storage costs for live fish. On the other hand, wholesale prices for Epinephelus malabaricus, E. tauvina, E. coioides, and E. fuscoguttatus may vary from US$ 20/kg in Hong Kong to US$ 5-15/kg in Thailand, depending on quality and size (www.enaca.org/ grouper/research/economics/1999/04/market.htm).

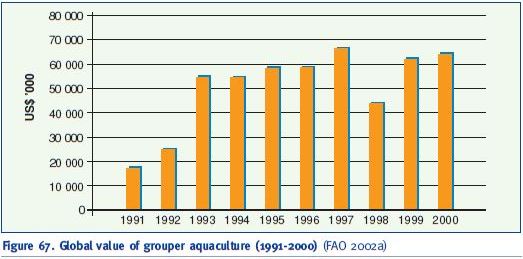

Figure 67 shows that the farm-gate global value of the aquaculture production of groupers reported to FAO increased from US$ 17.3 million in 1991 to US$ 64.3 million (98% in Asia) in 2000. However, Sadovy (2000) estimated that the retail value of the groupers reared in Southeast Asia alone was US$ 575 million, assuming an average retail value (Hong Kong prices) of US$ 25/kg.

Figure 67. Global value of grouper aquaculture (1991-2000) (FAO 2002a)

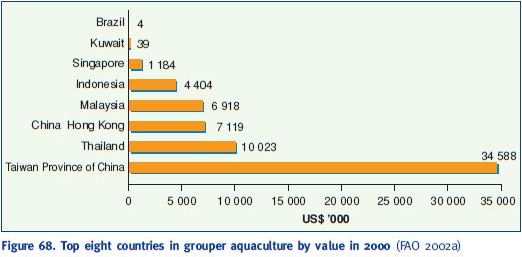

Figure 68 shows the value of the production of the top ten producers, according to FAO (2002a). The most important market areas are in China and Hong Kong but there is also significant demand for groupers in Japan, Taiwan Province of China and Singapore. Demand is also increasing in the Republic of Korea, Thailand and Malaysia.

The value of the production of some specific cultured grouper species in 2000 was as follows: greasy grouper (E. tauvina) aquaculture production reached US$ 6.9 million in Malaysia and US$ 5.5 million in Hong Kong in 2000; areolate grouper (E. areolatus) production in Hong Kong was US$ 1.7 million, while orange-spotted grouper (E. coioides), cultured in Kuwait, was valued at US$ 39 000 (Fishstat Plus 2002).

An important characteristic of the grouper market is ethnic consumer preference. The domestic demand in Brunei Darusallam is quite small; most of the local people believe that eating groupers is not healthy, especially for those suffering from asthma. However, groupers are one of the most favoured fish for Chinese people.

Figure 68. Top eight countries in grouper aquaculture by value in 2000 (FAO 2002a)

Exports of grouper to Hong Kong are by air or by live vivier boats. While air freighting is worthwhile for high-value grouper species, boat transport is more convenient and cost effective for the more ordinary, lower-value species. Comparisons between these two modes of transporting live groupers to Hong Kong were presented in a study by Pudadera, Hamidand and Yusof (2002). Live groupers transported by air were marketed direct to the Hong Kong wholesale auction market, where they fetched an average price of US$ 21/kg; groupers transported by a vivier boat were purchased at the farm price, i.e. the Hong Kong buyer collected live groupers directly from the farm and purchased them for US$ 8.50/kg. The average net profit (after deducting the transportation fees) for the live groupers shipped by air was US$ 8.73/kg, while those collected from the farm by vivier boat had a margin of US$ 7.78/kg.

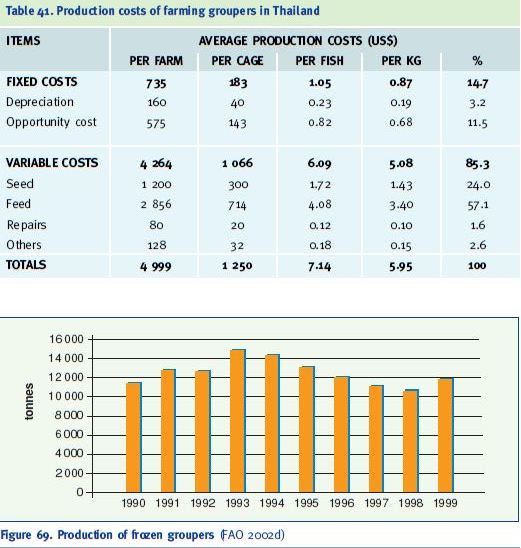

An example of the production costs for grouper culture from a study by Boonchuwong and Lawapong (2002) is shown in Table 41. In this survey, the average revenue per farm was US$ 9 800, with an average net profit of US$ 4 800. Since approximately 85% of the total production of cage cultured groupers in this study was exported, the marketing system was geared to the requirements for live fish export. The marketing process consisted of a number of steps, with few traders being involved because the output had to be distributed quickly. The major agencies involved in the marketing system were brokers, collectors (wholesalers) and exporters. The average marketing costs of collectors were US$ 1.06/kg or US$ 1.20/fish and the average net profit was US$ 0.52/kg. The marketing costs of a collector averaged US$ 878/month, with a profit of US$ 432. For an exporter, marketing costs averaged US$ 4 000/month and the net profit was US$ 3 775/month. Exporters get the highest returns of all the traders involved in the live grouper marketing system, since they have better access to foreign marketing information and price movements. They also have to be compensated for the risks which they take, for example the death of valuable live fish during transport. However, with respect to the marketing system as a whole, farmers get the highest share, which accounts for nearly 55.5% of the price the foreign importers have to pay. From the traders share the exporters get the highest share (37%), whereas the collectors get only 7.5%.

Groupers are also traded internationally in whole, dressed, fresh/chilled or frozen forms. In Southeast Asia fresh/chilled groupers are sold through supermarkets, mainly in the dressed form. The USA is a potential market for processed groupers, both in dressed and fillet forms. Large quantities of groupers are already imported into the USA, mainly from the central American countries (Pawiro 2002). Grouper imports by the USA in 1999 (FAO 2002d) were 4 170 tonnes in fresh or chilled form and 330 tonnes frozen, with a total value of US$ 17.7 million.

Exports from India, Indonesia and Thailand are predominantly frozen fillets (Pawiro 2002). According to this author, prices of chilled grouper fillets from Latin America range from US$ 3.50 to 5.80/kg. Frozen groupers are exported to the USA for US$ 1.50-2.00/kg for whole/gutted fish and US$ 3.00-3.50/kg for fillets.

Production of frozen groupers peaked in 1993 but, by 1999 had returned to 1990 levels (Figure 69). In 1999 the leading producers of frozen groupers were in North America (Mexico: 7 603 tonnes), followed by Asia (Philippines: 3 720 tonnes), Africa (Senegal: 326 tonnes), and Europe (Greece: 130 tonnes).

Table 41. Production costs of farming groupers in Thailand

Figure 69. Production of frozen groupers (FAO 2002d)

Although the authors of this report have made extensive efforts to analyse and consolidate market information and data, it is felt that there are gaps in the data presented here. All potential investors should undertake their own detailed evaluation of the prospective markets.

The principle reasons for the inconsistency of the data are:

? It is difficult to make accurate or useful assessments of any type of aquaculture without specific reference to local prices and circumstances. These are extremely variable throughout the Southeast Asian region.

? Production parameters, especially survival rates, have a wide range and/or are poorly reported.

¦ Conclusions

The future development of the capture based aquaculture of groupers is likely to be influenced by several key requirements:

? The development of markets which are outside the specialist live markets.

? Production methods that can produce groupers at significantly lower costs so that “non-live” markets can be accessed at a profit.

? The development of better catching and culture methods to reduce the excessive wastage of juveniles, resulting in additional hatchery production.

? The development of better feeds to move away from the reliance on trash fish. ? Better management and control of diseases.

? The development of new culture systems that allow culture activities to be moved beyond congested and polluted port areas.

Groupers have high quality flesh, and are recognized worldwide as a good eating fish. With the demise of many traditional white fish sources, a high quality marine fish will always find a market. Grouper products could be well placed to access the market for white fish fillets, which are popular in both the USA and Europe.