ADVANTAGES OF CBA OF COD

Harvesting of cod has always been important for people inhabiting the Norwegian coast. It is the most valuable species for the industry in terms of both revenues and employment. The traditional way of organizing the industry has been through fishing licences for professional fishermen that catch the cod in winter close to the coastal areas in the northern part of the country. Due to the seasonal migration pattern of cod, i.e. mature fish migrating to their spawning areas or immature cod hunting capelin, harvesting in winter is an efficient fishery, with high catch per unit effort (CPUE) and low costs.

Improvements in technology related to finding and catching cod have made it necessary to implement management regimes to ensure sustainable harvest levels. This process has led to fewer vessels and fishers. In order to cope, fishers have had to devise ways to increase the volume of catch or to add value to a fixed quota. In the search for this, CBA has received attention particularly in recent years.

Capture-based aquaculture of cod is based on competitive advantages in relation to traditional capture harvesting. These advantages rest on major weaknesses in the traditional way of harvesting cod. First, the cod quota has recently been set at a historically low level, meaning there is a lack of supply on several markets. Second, the short fishing season opens the possibility of receiving a price premium if sellers are able to supply the markets with cod out of season. Third, if you are able to grow wild fish in cages, the volume increases accordingly to a sustainable level of catch. Last, consumers prefer fresh and high quality cod and CBA is well suited to serve such market preferences.

A closer look at how the traditional catch of cod has developed reveals several aspects that point in the direction of increased cod CBA. As stated earlier, the interest

FIGURE 4

Changes in the Norwegian cod fishing quota since 1977

Source: Norwegian Directorate of Fisheries.

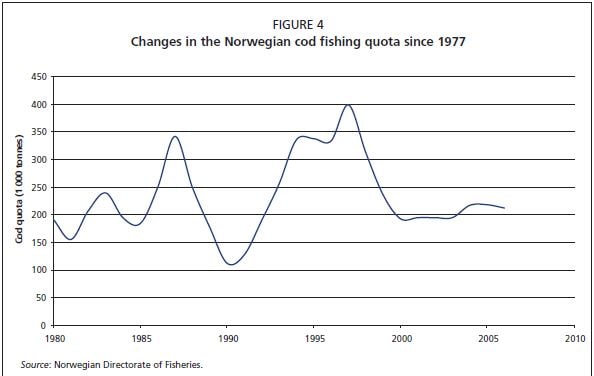

for catching live cod is closely related to the size of the cod quota. In periods with low quotas the interest is high and vice versa. Figure 4 presents the Norwegian cod quota for the last three decades. Not surprisingly, major technological breakthroughs related to CBA were achieved during the period 1988 to 1995. However, fishers lost their interest in CBA in the mid-1990s when the quota increased again. As shown in Figure 4 the quota fell to a low level in 1998, opening new boundaries for cod CBA.

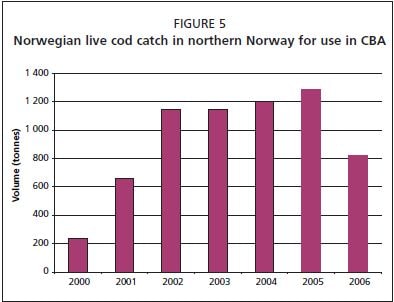

During the period 1990 to 1994 the annual catch of cod for farming was around 1 000 tonnes. The development of knowledge and technology in the 1990s laid a good foundation for the new interest (Midling, 1994; Midling, Beltestad and Isaksen, 1996; Akse and Midling, 1997; Midling, Beltestad and Isaksen, 1997; Midling et al., 2005). Figure 5 shows the annual catch for farming since 2000 in the northern part of Norway which is the most important region for cod CBA. In 2005 the quantity of cod delivered live at the national level reached a peak of approximately 1 500 tonnes.

As can be seen from Figure 5 there was a considerable drop in live catches from 2005 to 2006. This is not explained by a drop in catch quota, but mainly by market price changes. The price for cod caught live was in 2004 and 2005 almost 45 percent higher than the price for ordinary wild-caught

cod. Although the fishers experienced a rise in cod prices in 2006, the price premium for live-caught cod dropped to only 30 percent. The price premium fishers receive for catching live cod thus also impacts on the development

FIGURE 5

Norwegian live cod catch in northern Norway for use in CBA

near future, although the current catch level is far below this goal. In the summer of 2007 the Government announced that it will provide a quota premium for each kilogram of live caught cod. This was put into force for 2008, and only 80 percent of the live fish weight was deducted from vessel quota. A marked rise in landings indicate that this is an effective instrument. Furthermore, it will financially support investments needed to improve vessels and to establish infrastructure for storing live cod.

Seasonal pattern

Live cod is mainly caught by Danish seiners along the coast of Finnmark, Lofoten and Vesteraalen off the Norwegian coast from April to June, with the largest volumes caught in May. These areas are important fishing grounds in northern Norway and yield substantial catch of cod and other species throughout the year, with Finnmark dominating the catch levels.

Figure 6 marks the main cod fishing grounds and spawning areas in Norway along with the five CBA farms that buy live cod (regular full cycle cod farms are not marked).

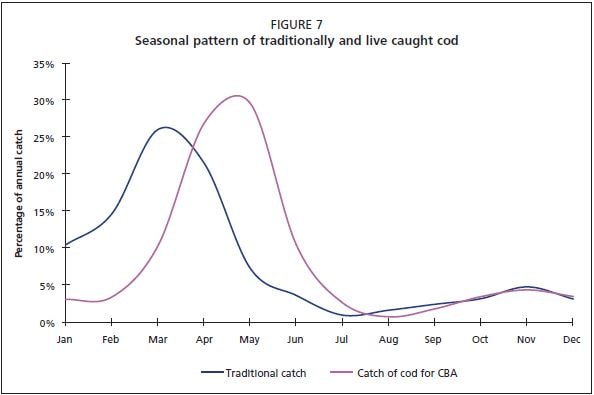

Another interesting dimension of the live capture of cod is the seasonal pattern as shown in Figure 7. It seems obvious that the fishers find the period from April to July the most desirable month to carry out fishing for live cod. The traditional fisheries for cod have, as shown in Figure 7, a rather different pattern. One reason for this might be that vessels give priority to the traditional cod fishing season which runs from January to April. They then participate in the live catch when there is more time available for this activity.

The fishing grounds close to Finnmark have a dominant position in the fishery. This is due to the time of year live when the catch of cod is carried out, the migratory pattern of cod and its accessibility. The cod caught are mainly capelin cod, some smaller cod from the coastal stock of the Gadus morhua species or spent cod on its way back to the Barents Sea. The catch of live cod is carried out in a region and at a time of year when the cod is close to shore. This time of year

FIGURE 6

The main CBA fishing grounds off Finnmark County and cod spawning area off Nordland County

coincides with calmer weather and better conditions for both harvest activities and live transport.

Adding value or minimizing costs? Detailed studies of the industry structure related to CBA reveal that over the years there has been substantial structural change in the wild cod fleet. During the period 2000 to 2006, there have been nearly 200 different vessels delivering live cod. Of these, 140 vessels delivered less than 5 tonnes during the 6 year period, and only 14 delivered more than 100 tonnes of cod. Only 15 vessels delivered cod every year in the same period. Even among these vessels, only a marginal volume of their total cod quota is caught live.

Of the 7 000 tonnes live caught cod during the period from 2000 to 2006 almost 6 000 tonnes were caught by Danish seine. The number of years each vessel delivered live cod, combined with

FIGURE 7

Seasonal pattern of traditionally and live caught cod

the distribution of catch between the vessels, indicates that there are almost 20 Danish seine vessels that maintain continuity in the cod fisheries. These vessels have several similarities; they are very flexible regarding their fishing gear; they switch easily between purse seine and Danish seine; and many are set up to transport the live fish from the fishing ground to the recovery cages in bulk. Furthermore, these vessels do not have licences for fishing other species such as herring and mackerel thus allowing them to concentrate on cod fishing. Another important characteristic for these vessels is that they only catch part of their cod quota live. In other words, they take advantage of the possibility to add value to their cod quota by delivering it live because they have the time and are properly equipped.

The reasons that so many vessels find it interesting to keep up with the live cod fishery, but not make a permanent commitment are many and complex. Empirical findings indicate that the size of the cod quota, quota portfolio, price premium, risk and legislation are important factors that influence the decision of whether or not to continue with live catch. Another problem is logistics. High fuel prices and long transport to the acclimatization cage sites are reasons for not engaging in live catch. The development of transportable storage cages or other infrastructure solutions, such as acclimatization cages close to the fishing grounds, are necessary. Additionally, CPUE and costs are important factors to consider when choosing a harvesting strategy that optimizes the profit of a fixed cod quota.

The initial cost to equip the vessel for live catch is estimated by the Foundation for Scientific and Industrial Research at the Norwegian Institute of Technology (SINTEF) to be from €67 000 to €100 000 depending on the size of the vessel (Aasjord and Hanssen, 2006). If it becomes necessary to upgrade to a more powerful engine the cost increases by €40 000. In any event, the issue of lower capacity for catch, loading and transportation of live fish will always have to be considered when planning the future use strategy of the vessel.

The fishers carrying out the live cod fishery for the CBA industry are also important contributors to traditional fisheries. As a result, there will always be a trade off between how, when and what will receive priority. Over the years, the average price of live cod has been 30–40 percent higher than the price of traditionally caught cod. However, due to the fact that the live cod fishery is more time consuming and vulnerable to weather conditions, each year fishers have a difficult choice as to whether or not they should engage in the CBA fisheries. As the peak season for traditional cod fisheries is earlier than the optimal period for catching and storing live cod fishers must decide at the beginning of the year whether they should leave some of their cod quota in the hope that the increased price of live cod will outweigh the extra time and effort spent on catching them.

Optimizing profit includes a complex evaluation of how these factors will develop. Empirical studies indicate that they change rapidly and in directions difficult to predict. Mapping of important factors – with impacts on what strategy to choose – reveal that the vessels chose different variations of volumes of wild-caught cod, as shown in Figure 5.

Market positioning

Although there is minimal research on the organizational structures of the CBA industry its organizational pattern is built on the same basis as the traditional cod fisheries. The ownership of the fish changes the moment it transfers physically from the vessel to the buyer. The start up cost of participating in the CBA seems to be shared between the participants. The owner of the vessel invests in the equipment necessary to carry out the fisheries, the transport of live fish and the handling of the fish on board the vessel. The buyer, i.e. the shore-based industry, invests in the necessary fattening cages and equipment for slaughtering and production.

The industrial buyer

The competitive situation in the Norwegian industry calls for an increased interest in CBA from an industrial point of view. Recent years have brought about an increase in consumption of fresh seafood products and a higher demand for stability in supply. Supermarket chains want to be able to offer the same product portfolio all year round. It is impossible for the Norwegian industry to meet such obligations by depending only on the supply of wild cod due to the migratory pattern of this fish species.

The processing industry buying live cod is mainly located in Finnmark, even though many of the vessels deliver to the Lofoten and Vesteraalen areas. This is no surprise considering that the main fisheries are carried out off the coast of Finnmark. For these companies it is evident that the farming and production of live cod is only a supplement for their traditional production. The companies commonly have a portfolio of products which changes by season and with access to raw material. This access can be better controlled by the company when they store the cod live, compared to depending only on traditionally caught wild cod. Some cod fish farmers use CBA cod in addition to farming cod seed supplied from hatcheries.

Studies by Dreyer et al. (2006) indicate that the interest in buying live cod fluctuates from year to year. In the period from 2000 to 2006, there have been 33 different buyers involved. Of these, 27 tried out the concept for one or two years before deciding not to continue. Four companies purchased more than 500 tonnes (cumulative) of live cod throughout the aforementioned period, and only 2 companies continued to buy the fish on a regular basis. Occasionally, as much as half the total catch of live cod is bought by one company, however never the same company every year. This has caused a problem for the stable part of the industry due to the numerous companies testing the live cod market. This causes instability in access to live cod and also forces prices to rise. The decision to withdraw from this supply market is, however, not only due to negative experiences from the capture-based concept. There has also been a great deal of turbulence in general in the industry during this period.

Marketing strategy

Marketing strategies have been developed for live-caught and farm-raised cod. One of the main competitive advantages of live cod is its freshness and constant quality. To thoroughly take advantage of this benefit it is important to know if farm-raised cod maintains the quality level expected by a highly demanding fresh fish market. A quality study carried out in 2001 showed significant variation between wild, CBA and full-cycle farmed cod (Johansen and Johnsen, 2002). In the same study a test was carried out amongst Norwegian chefs. Compared to farmed cod the CBA cod was given a low score on quality. Of 13 chefs, ten said that they would not consider buying CBA cod for their restaurant due to the soft texture and high degree of gaping. A second and more extensive study was carried out in 2002 by Heide et al. (2003). This time both the farmed and the CBA scored good results in terms of quality and, in contrast to the earlier study, the chefs were satisfied with the consistency of the CBA fish. The conclusion of this exercise indicates that CBA cod shows a substantial variation in quality, thus further research is needed to ensure that CBA cod maintains the quality level demanded by the market.

The development of CBA knowledge and marketing know-how are critical issues. It is necessary to find out if CBA cod have any competitive advantages and how these advantages can be fully exploited to improve profitability and add value to the available cod quota. Two marketing strategies can be considered: a) using the same channels as wild cod for distribution, sales and marketing of CBA cod; and b) differentiating CBA cod from the wild cod.

Branding regulations within the EU (Council Regulation [EC] 104/2000 of December 1999 on the common organization of the markets in fishery and aquaculture products) require that all fresh-farmed fish that are sold to consumers be branded as “farmed” and marketed as farmed fish. Furthermore, the Norwegian legislation (Aquaculture Act) specifies that wild-caught marine fish that are artificially fed shall be regarded as farmed fish and thus should follow the aquaculture legislation. Today, farmed cod is distributed and sold using the same channels as wild cod. In many ways this is a natural strategy considering the small amount of farmed cod that is available. The volume is far too small to be able to take advantage of the potential competitive advantages, such as supply stability to producers and consumers. However, the traditional full-cycle aquaculture of cod must be branded as “farmed”, and can be perceived as being different to wild cod. Furthermore, the CBA cod should be marketed as a separate product.

It has not yet been studied whether or not CBA cod has characteristics that make it possible to differentiate it from wild caught cod in other ways than by name only. However, research carried out on CBA Icelandic cod has shown that this cod has qualities which made consumers from different countries perceive that it was different from the Icelandic wild cod (Sveinsdottir, 2006). In this study, CBA cod was perceived to be “meatier” than the wild cod and as much as 23 percent of the invited consumers preferred CBA cod. If further research of the Norwegian CBA cod reveals similar differences, there would be the potential to propose the CBA cod to consumers who prefer such qualities.

Tracing the cod in the market

Cod is mainly caught near the coast of Finnmark during spring time. It is difficult to trace CBA cod once it leaves the Norwegian producer. Interviews with participants in the CBA sector reveal how and where the cod ends up and eventually positioned in the market compared to traditional wild-caught cod. The main impression is that CBA cod is used as a supplement to the traditional production of fresh filets or exported as fresh whole fish.

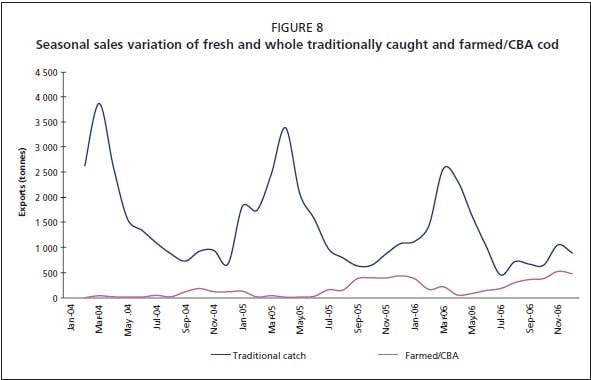

Figure 8 shows how the export of fresh whole cod evolved, on a monthly basis, from February 2004 to December 2006. The export is divided into traditionally caught cod and cod that are CBA or farmed. The figure shows that Norwegian export is dominated by traditionally caught cod. The quantity of traditionally caught cod, which is exported, coincides with the seasonal pattern of the traditional cod fisheries. The main quantity of cod is caught during the winter months.

FIGURE 8

Seasonal sales variation of fresh and whole traditionally caught and farmed/CBA cod4 500

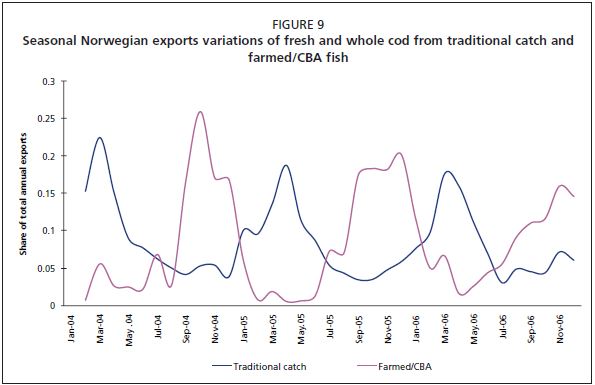

The industry based on CBA or farmed cod is expected to take advantage of the demand in the market for fresh cod in the months of the year when traditionally caught cod are scarce. Figure 9 shows the seasonal export of wild-caught cod and farmed/CBA cod.

The figure shows that farmed or CBA cod are placed on the market at a time of year when traditional cod fisheries are slow. As opposed to traditionally caught cod, the farmed or CBA cod are placed on the fresh fish market from September to December, supplementing the wild fisheries cod market, even though the quantity is less.

If the annual demand for fresh cod remains high as during the main exporting months, there is still room for a substantial increase in the quantity of farmed and CBA cod. How big an increase the market will accept is difficult to predict. The monthly amount of cod exported during the critical months lies between 3 000 and 4 000 tonnes of whole cod. If the market demand for fresh cod remains stable the whole year, the

FIGURE 9

Seasonal Norwegian exports variations of fresh and whole cod from traditional catch and farmed/CBA fish

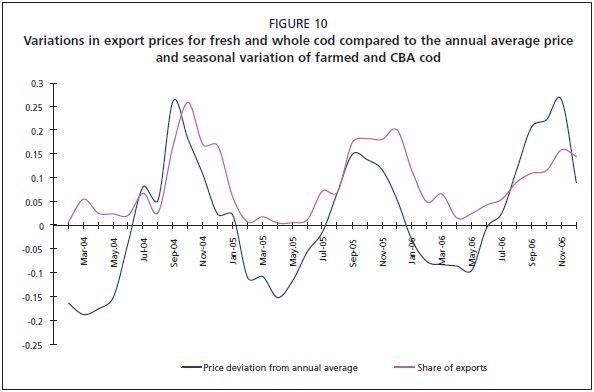

FIGURE 10

Variations in export prices for fresh and whole cod compared to the annual average price and seasonal variation of farmed and CBA cod

total possible export of fresh cod would be around 40 000 tonnes. In 2004 and 2005 the total export of fresh cod was around 18 000 tonnes.

Figure 10 shows that the price for fresh cod varied substantially over the years. During the two years presented the price was above average in the autumn period and at its lowest during the first months of the year. Exported farmed or farm-raised cod are sold in the period of the year when the price premium is highest. The industry adjusts production so that it can place the product on the market at the best possible time to supplement the traditional fisheries. One of the main challenges the traditional industry is facing is supplying the market all year round.